Articles

However, if the assets was utilized predominantly in the usa, the entire loss decrease U.S. supply income. The reason from a knowledge edge work for to your knowledge expenses of your own dependents is determined according to the area of one’s principal office. A knowledge perimeter work for includes money only for next costs to own degree from the a basic or secondary school. The reason of a housing perimeter work for is determined based on the spot of the principal work environment. A property edge work for includes costs to you otherwise on the part (as well as your family members’ if your family members schedules with you) simply for another.

Range 51: Part-seasons New york city resident taxation

Juan makes the first-year option for 2024 while the up to 5 days away from absence are believed days of presence to own purposes of the new 75% (0.75) requirements. Robert concerned the us since the a great You.S. citizen for the first time may step one, 2023, and you may stayed up to November 5, 2023, when Robert gone back to Switzerland. Robert came back to the Us for the March 5, 2024, as the a legitimate permanent resident nevertheless lives right here.

Concurrently, complete any federal Variations 1099-G and you can W-2G that demonstrate any Nyc County, New york city, and you will Yonkers income tax withheld. If your matter advertised on line 56 is actually $step 1,700 or maybe more, you need to over Mode It-135, Transformation and use her comment is here Taxation Statement to own Orders away from Issues and Characteristics Charging $25,one hundred thousand or maybe more, and you will fill out they with your come back. Should your decedent have several beneficiary, the newest decedent’s $20,000 retirement and you will annuity money different must be assigned one of the beneficiaries.

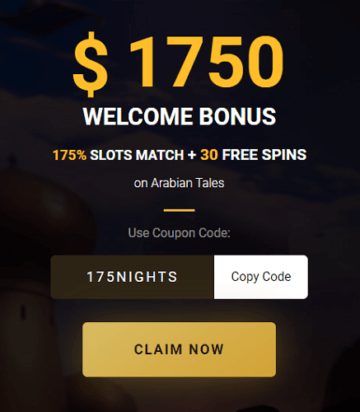

What is the low deposit number I can generate in the online casinos?

In the event the both the failure-to-file punishment and also the inability-to-spend penalty (mentioned before) pertain in just about any month, the five% (otherwise 15%) failure-to-document penalty are quicker from the failure-to-pay penalty. However, for individuals who file your own get back over 60 days after the deadline otherwise prolonged deadline, the minimum punishment is the shorter from $510 otherwise a hundred% of one’s unpaid taxation. If you are a member of staff and you also found earnings susceptible to U.S. tax withholding, might fundamentally file by the fifteenth day of the brand new 4th week after your income tax seasons finishes.

- We’re going to not be prone to you to have declining a deposit, even though it grounds us to decline people transactions you have already generated.

- The metropolis out of Tampa’s Leasing and you will Flow-inside the Direction Program (RMAP) brings owners which have financial help which can were but is maybe not restricted to shelter deposits, basic and you will history few days’s lease, past-due lease, and/otherwise a restricted month-to-month subsidy.

- Get into that it password if you qualify for an automatic a couple-few days expansion of time to help you file their federal return as you are from the country.

- For individuals who filed a good 2024 go back for the Form 1040-NR and predict your revenue and total deductions to own 2025 to help you become nearly the same, you can utilize your own 2024 get back because the a guide to done the new Projected Income tax Worksheet on the Mode 1040-Parece (NR) tips.

- On-university work includes performs did from the a through-university place which is educationally associated with the school.

When there is no related line to the Nyc Condition get back, declaration which money since the other earnings on line 16 out of Setting IT-201 or Form It?203. Document Form It?203?X so you can allege an individual income tax reimburse reliant a keen NOL carryback. File Form They-201-X so you can claim a reimbursement depending a federal NOL carryback in order to a taxation year after you had been an entire-12 months Ny Condition resident. To learn more about claiming your own taxation reimburse centered abreast of an NOL, understand the guidelines to own Mode They-203-X or the instructions for Form It-201-X. Should your pension and you will annuity money isn’t excused away from The newest York income tax and that is based on features did in-and-out Nyc State, go into the amount your acquired as the a great nonresident for the the total amount your features have been did within the Ny State. Get into one to part of the Column A good matter you gotten through your nonresident months.

Vermont Rental Guidance Software

Money on what the fresh income tax is just restricted to treaty, yet not, is roofed inside revenues. If perhaps you were paid back by a foreign company, your U.S. resource earnings may be exempt from You.S. taxation, but as long as your satisfy one of several things chatted about 2nd. There may not any 30% tax to the specific brief-term investment obtain dividends away from offer within the All of us you to you can get out of a common financing or any other RIC. The brand new common fund tend to designate written down and this returns try quick-name money acquire dividends. Which tax relief cannot affect you while you are contained in the us to have 183 months or more while in the the taxation season. Costs to particular persons and you may payments of contingent focus do not meet the requirements while the profile focus.

Company Insider says to the new imaginative tales you want to know

Particular fringe pros (for example housing and degree) is sourced to your a geographical basis. When you are a good nonresident alien in the usa and you may a bona-fide resident from American Samoa or Puerto Rico during the the whole taxation year, you’re taxed, which have particular conditions, according to the legislation to have resident aliens of the United states. For more information, find Real Owners from American Samoa otherwise Puerto Rico inside chapter 5.

Considering confidential fraud and you can very important risk conditions, it could be modified at the the discernment as opposed to advance observe. County given up assets law set advice less than and therefore unclaimed property must end up being surrendered to the applicable county. Essentially, the cash in your account are believed unclaimed if you have perhaps not had one pastime otherwise communication with our company concerning your membership during a period of decades, discussed by the county away from house. The items are subject to abandoned possessions legislation, as well as IRAs and Dvds. Should your finance is actually surrendered for the condition, you might be able to recover him or her, your claim may prefer to become presented to the state.

You should check the fresh “Yes” box regarding the “Third-People Designee” part of your own go back to approve the new Internal revenue service to go over their return which have a buddy, a relative, or other individual you select. This permits the brand new Internal revenue service to-name whom you defined as your own designee to answer any questions which can happen within the handling of your return. In addition, it allows your designee to perform particular actions for example asking the fresh Internal revenue service to possess duplicates from notices or transcripts associated with your own return. Repaid Preparer’s Suggestions – For individuals who pay anyone to prepare your Setting 540, see your face need to indication and you will complete the appropriate paid off preparer information on the Top 6 and a detection count.

The protection put has got the landlord that have warranty that renter will pay the newest lease in full and on day, take better care of the property, rather than cause damage beyond normal deterioration. To help keep tabs on money, landlords are using on the internet applications to get shelter deposits, book, and you can fees. On the internet rent collection gets tenants the flexibleness to spend the method and you will dumps repayments into a business family savings to own landlords. To start collecting book and you may shelter places on the web, do an account with Baselane.